Alpha Homora and Iron Bank at a stand-off, Silvergate Bank in troubled waters, Oasis App clarifies vulnerability that enabled reverse exploit, Q&A with Alpha Ventures DAO, ...

Issue #31 of The State of DeFi Lending newsletter

Welcome to issue #31 of The State of DeFi Lending, a newsletter covering the highlights of lending markets in DeFi.

In this issue we cover

Alpha Homora (AH) and Iron Bank (IB) are facing off over $32m in bad debt AH owes to IB. AH depositors’ funds are frozen in IB and cannot be withdrawn. This sets a precedent as IB is holding AH users accountable for protocol bad debt.

Silvergate Bank has delayed the publication of its 10K for 2022 and puts its ability to survive in question. The Bank has seen an exodus of clients.

Oasis App explained that the vulnerability that enabled the reverse exploit has been patched. The code allowed for an external party to access user funds with the team’s permission.

Q&A with Alpha Ventures DAO

Read below for more…

News

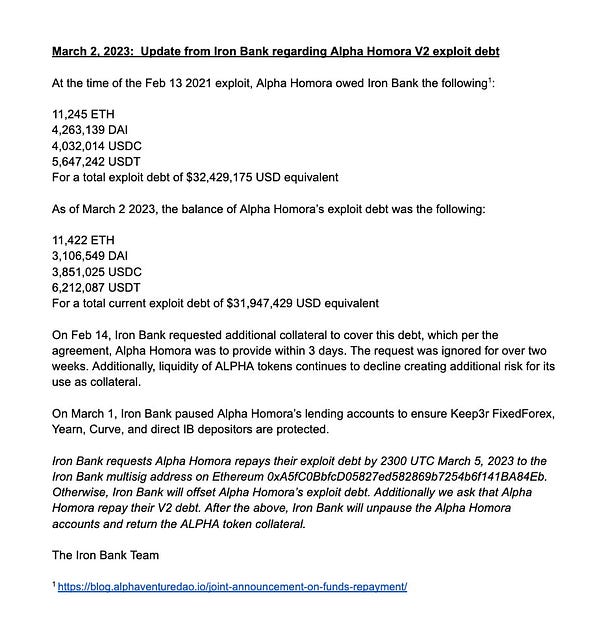

Alpha Homora (AH) & Iron Bank (IB) are at a stand-off over $32m bad debt Iron Bank incurred as part of an exploit in Feb 2021, caused by a glitch on the part of Alpha Homora.

Alpha Homora was one of the first protocols to enter DAO-2-DAO protocol relationship with Iron Bank to receive undercollateralised loans. As a consequence, IB held no collateral to liquidate when the hack happened but relied on financial guarantees by AH.

To resolve the situation, both parties agreed a scheme to make Iron Bank whole: 20% of AH‘s revenue and 50m in $Alpha token as collateral. The revenue split has generated $5k in monthly revenues and the $Alpha token price has declined significantly in price since the agreement was struck.

It appears the situation accelerated as the $Alpha token fell significantly and in return impaired the collateral value. IB asked for the collateral to be topped off and didn’t receive a response within a 3 day deadline.

As of 1st March, Iron Bank has frozen all AH user deposits into IB to enforce a bad debt repayment. The Iron Bank team updated a contract configuration to freeze the deposits. Iron Bank is basically holding AH‘s depositors accountable to repay AH‘s DAO debts. The total amount of frozen assets is about $50m, significantly more than the $32m bad debt.

These actions set a new precedent on how financial responsibility is shared between a protocol and its users towards external partners. Besides, it challenges the notion of decentralisation in DeFi.

AH has issued a series of tweets and Open Letters to appeal to IB and the DeFi community.

AH is actively trying to mitigate the impact on its users through legal means, white hat hackers and calls to Circle/Tether.

IB set a deadline of 5 March, 23:00 GMT to receive the bad debt repayment and a repayment of all AH v2 debts. IB has expressed it discontent with AH’s latest proposal and thus the situation remains fluid.

At the time of writing, IB has released AH user deposits on Avalanche, Fantom and Optimism. Deposits on Ethereum Mainnet remain stuck.

Silvergate Bank, one of the largest banking partners to crypto exchanges and market makers, has delayed its financial results for 2022. It also saw a downgrade of its credit rating by Moody’s.

The Bank indicated it might not be “going concern” as its capital base has been weakened in the wake of the crypto downturn in 2022. The cause of the issue is a typical asset-liability mismatch combined with a rising interest rate environment , which pushed down the value of bonds the bank holds on its balance sheet. The crypto market implosion led to massive customer redemptions which Silvergate could only service by selling these fixed income securities at a loss to book value.

Unsurprisingly, markets took a beating after the announcement. Major players like Coinbase, Crypto.com and Paxos have publicly declared immaterial exposure to Silvergate.

Silvergate suspended its Silvergate Exchange Network which forms a major liquidity backbone for market makers on CEXes.

*Latest update as of March 8th - Silvergate Capital Corporation Announces Intent to Wind Down Operations and Voluntarily Liquidate Silvergate Bank.

The Oasis CEO came forward explaining technical changes to avoid a replay of last week’s “reverse exploit”.

This reverse exploit was only possible as white-hat hackers identified a vulnerability in Oasis’s ability to upgrade the smart contracts that manages the vaults with the stolen funds

The flaw in that part of Oasis’ software made it possible for a third party to access user funds but only with Oasis’ permission.

The Defiant published a good explainer video about the details of the reverse exploit.

Announcements and short news

Q&A with Alpha Ventures DAO

Homora is a leveraged yield farming protocol deployed on Ethereum mainnet, Fantom, Avalanche & Optimism. It was developed by Alpha Ventures DAO. Alpha Homora (AH) pioneered the leveraged yield farming product when it launched in 2020. Users can amplify returns by utilising leverage in their yield farming strategies.

Alpha Homora was one of the first protocols to enter a DAO-2-DAO protocol relationship with Iron Bank (IB) to receive undercollateralised loans. In February 2021, Alpha Homora was exploited and left Iron Bank with $32m in bad debt. In return, both parties agreed a scheme to make Iron Bank whole: 20% of AH‘s revenue and 50m in $Alpha token as collateral.

As of 1st March, Iron Bank has frozen AH‘s user deposits worth $50m and set a bad debt repayment deadline as of 5 March 23:00 GMT. AH considers these actions unjustified and illegal. AH’s open letters to appeal to IB and the DeFi community can be found here.

So far, no mutually acceptable agreement has been reached.

We reached out to the Alpha Ventures team and received the following responses to clarify the situation.

As per Iron Bank’s communication, the revenue split generated $5k in monthly revenues. How far does this correspond to reality?

This is not the complete picture. In 2021/2022, 20% of the protocol fees equate to a lot higher amount for example this payment that was done in April 2021 (see Etherscan tx here).

We also added all these transactions on this Excel which is also included in the first Open Letter.

Separately, please do note that whatever the amount becomes, it is still the agreement that Iron Bank accepted, and they cannot freeze users' funds when they just wanted to change the agreement. If they wanted to change the agreement, then they should have told us before taking any of these actions, but they never told us.

IB states that as no mutually satisfactory agreement was reached, IB froze AH user deposits by a contract upgrade.

This is also not quite true either. Pls see details of what actually happened under "Here is what happened" section on this blog: https://blog.alphaventuredao.io/an-open-letter-to-iron-bank/

What has caused the sudden escalation in the relationship with Iron Bank?

To be honest, I have no idea because they didn't communicate frustration or anything. Even the call on Feb 14th was a friendly call. And then this happened