ETH Liquid Staking Derivatives on the rise, Aave v3 launches on ETH mainnet, NFT Lending in the spotlight, GUSD FUD,...

Issue #24 of The State of DeFi Lending newsletter

Welcome to issue #24 of The State of DeFi Lending, a newsletter covering the highlights of lending markets in DeFi.

In this issue we cover

The upcoming Ethereum Shanghai upgrade is turbo-boosting Liquid Staking Derivatives (LSDs). Lending protocols are positioning to capture the expected growth and start onboarding LSDs as collateral assets.

Aave v3 is expected to launch on the Ethereum mainnet this week. This is a highly anticipated protocol upgrade as it incorporates various new features. V3 will launch with 7 assets and support eMode for wETH and wstETH.

NFT Lending has been gaining a lot of traction given how resilient NFT collections have been trading during the midst of the recent market turmoil. Lenders have seen mostly positive returns, fuelling increased interest to deploy funds.

Gemini’s future is closely linked to that of Gemini Earn and Genesis which owes $900m to the former. Gemini is also the issuer of the GUSD stablecoin to which the MakerDAO PSM has a $500m exposure. Tyler Winklevoss gave an update to reassure the community but is not immune to FUD by community members.

Read below for more…

News

Liquid Staking Derivatives (LSDs) are at the center of attention driven by the Ethereum Shanghai upgrade, scheduled for March 2023. Staked Ethereum will be withdrawable and thus offering a mass-market compatible staking experience.

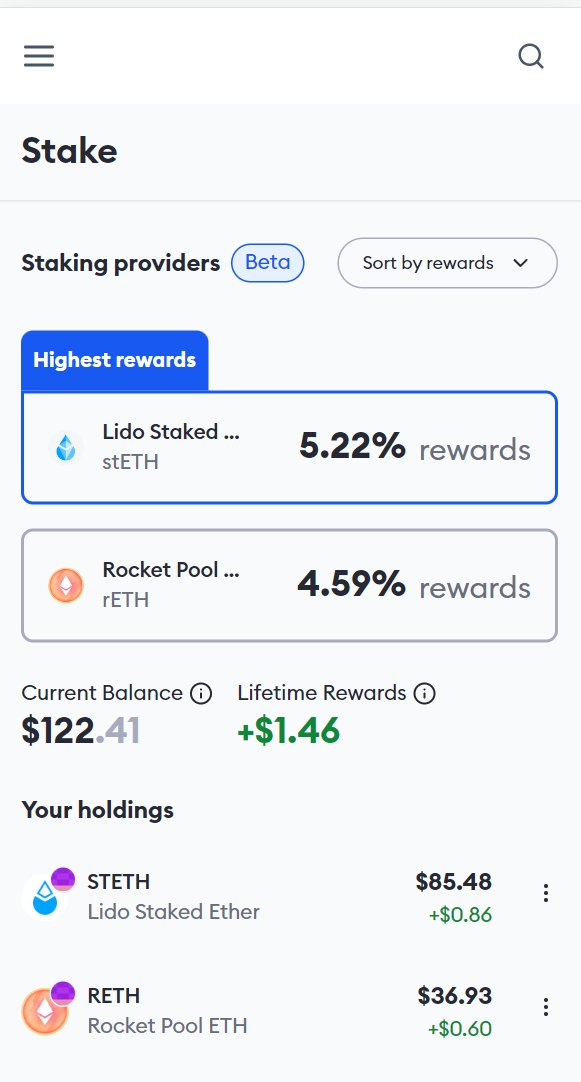

Metamask just announced a native integration with Lido and Rocket Pool to enable users to easily stake with these protocols.

It is expected that more ETH will be staked and converted into LSDs. In addition, currently staked ETH might look for a new home once the withdrawals are live. This is an excellent thread that explains how the unstaking process works in practice.

Delphi Digital published an excellent report that breaks down the various token designs as these LSDs differ substantially.

The anticipated growth in LSDs will reduce the available ETH & WETH that lending protocols can attract. However, liquid staking protocols are already working towards interoperability and composability of their LSDs. Early developments suggest that lending protocols will want a share of the pie and start onboarding LSDs as collateral assets.

Myso Finance is focusing their mainnet launch on Rocket Pool’s $RPL token and $rETH. The protocol incorporates novel mechanics such as liquidation-free, fixed-interest and oracle-free borrowing.

$rETH is also being onboarded onto Aave v3.

Redacted Cartel is working on an overcollateralized LSD-backed stablecoin called $DINERO.

The narrative of LSD-based lending is certainly catching on, also cross-chain. On Cosmos, Bamboo Zone is building a lending protocol for LSDs.

And on Polygon, Davos Protocol is working on an LSD-backed stablecoin.

The upcoming launch of Aave v3 (expected this week) is a significant milestone in the development of the protocol.

Aave is about to release V3 on Ethereum which will have 7 initial assets, support eMode for wETH and wstETH, and the interest rate models of v3 will be mostly following v2.

Here is an explanation of eMode.

Aave v3 is also accepting LSDs, starting with Lido’s stETH and RocketPool’s rETH.

Aave v3 will also lay the foundation for Aave’s $GHO stablecoin (see our newsletter #11).

If you want to find out more about the Aave vision, check out this recent podcast with Aave’s Stani on the past, present and future of the protocol.

https://www.reverie.ooo/podcast-episode/stani-kulechov-aaves-past-present-and-future

NFT Lending has been in the spotlight given the resilience of blue-chip NFT collections in the last months. Borrowers using NFTs collateral tend to repay on time, thereby providing a favorable risk profile to lenders.

NFT Lending has been profitable for most collections: As this thread shows, most lenders generated profits either through interest payment + repayment or by selling foreclosed NFTs at a profit.

The protocol design space is growing quickly. Most protocols are NFT-project agnostic, others focus on specific collections and ecosystems. The following non-exhaustive list highlights some key categories:

Peer to peer: NFTFi

Peer to pool: Benddao

NFT-backed stablecoins: JPEG’d

Lending DAOs: squiggleDAO pursues a loan-to-own strategy, specifically for squiggle NFTs, whereby they deploy their treasure as a lender and take possession of the NFT should the borrower default.

Nascent primitives: eg liquidity routing, buy now pay later

Cumulative loan volume has shown substantial growth throughout 2022 but is still only a fraction compared to fungible token lending.

NFT lending today is mostly focused on PFPs and 10k editions. However, as the NFT space evolves and large edition sizes come to market (eg Starbucks loyalty points, Reddit avatars), the NFT lending space is expected to grow overall loan volume.

Gemini-related FUD spreads to GUSD. MakerDAO has substantial exposure to GUSD through the PSM and the community now engages in intense debates about potential implications should Gemini face bankruptcy.

For reference, Gemini’s Earn product has lent $900m to Genesis which itself is facing financial difficulties. The Winklevoss twins, founders of Gemini, had addressed concerns about Genesis’ behavior in a public debate.

To address specific concerns from the MakerDAO community, Tyler Winklevoss published a lengthy post in the MakerDAO forum. The forum post explains the legalese of Gemini, Gemini Earn and GUSD with a focus on how bankruptcy-remote GUSD’s reserves are.

You can check out the entire forum post here.

Tyler also published additional clarifications on the MakerDAO discord.

Some MakerDAO community members have used this opportunity to apply their own interpretation, chief of which is Chris Blec.