Euler exploiter returns $5.4m, ParaSpace hack averted, Updates from MakerDAO, Alpha Homora proposes new solution to end stand-off with Iron Bank,...

Issue #33 of The State of DeFi Lending newsletter

Welcome to issue #33 of The State of DeFi Lending, a newsletter covering the highlights of lending markets in DeFi.

In this issue we cover:

Euler exploiter returns $5.4m and becomes the subject of a phishing attack by the Ronin hacker

BlockSec prevents $5m hack on nascent NFT lending platform ParaSpace

Updates from MakerDAO: Less USDC, more USD Treasuries

Alpha Homora issues 5th Open Letter to Iron Bank and the community to resolve the stand-off

Read below for more…

News

The individual responsible for stealing $197 million from Euler Finance returned $5.4 million (3,000 ether) to the DeFi lending protocol.

The exact reason for this remains unclear, but on-chain analyst ZachXBT speculates it could be due to a deal reached with Euler: The lender had previously offered a 10% bounty for the return of the remaining 90% of stolen funds within 24 hours, as well as a $1 million reward for information leading to the arrest of the attacker.

The identity of the exploiter remains unknown; however, they had previously sent 100 ether to a wallet linked to North Korea's Lazarus Group.

In a recent twist of events, the Ronin hacker is attempting to carry out a phishing attack on the Euler hacker.

BlockSec recently saved NFT lending project Paraspace from losing 2,900 ether (worth $5 million) due to a major vulnerability.

BlockSec acted as a white hat, detected the hack in real time, intervened before the attacker could strike and took control of the assets. BlockSec monitored the failed transaction and redeployed the contract with upgrades in order to rescue the assets.

Paraspace has paused its lending protocol and confirmed that all deposited NFT assets are safe. ParaSpace published a post-mortem confirming that the attack vector has been patched.

Maker Governance approved an extension from $500 million to $1.25 billion for its US Treasury investments.

In response to recent bank failures emphasizing the risks associated with centralized stablecoins, MakerDAO, the issuer of DAI stablecoin, is set to implement emergency governance measures to minimize its exposure to USDC. A "circuit breaker" feature will be introduced, enabling the protocol to reduce the debt ceiling to zero when necessary. The governance proposal backing these changes was published and approved following the USDC-depeg.

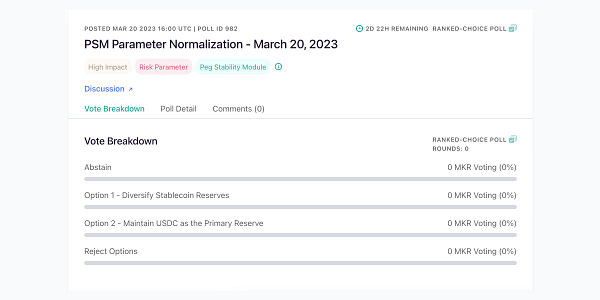

However, an ongoing vote suggests the community is still behind USDC as the primary reserve asset.

The stand-off between Alpha Homora and Iron Bank still has not been resolved. IB offered to individually unfreeze markets but AH declined arguing this would be unfair towards users.

On 21 March, AH has published the 5th Open Letter proposing to commit to paying IB ~1.89M USDT and ~1.92M DAI within 1.5 years, allowing ETH and USDC depositors on Alpha Homora v2 to withdraw excess amounts proportionately (~30% for ETH and ~57% for USDC).

As AH repays the debt, 63M locked ALPHA tokens will be returned from IB to Alpha treasury and distributed to affected users over time. Additionally, 20% of protocol fees from all upcoming Alpha products will be distributed to depositors over 1.5 years. Exact numbers are subject to agreement before execution if the proposal passes and IB accepts.

Alpha Homora is also shedding more light onto their roadmap in this latest open letter: Alpha is set to launch new products in Q2 building on their profit-sharing primitive and expanding beyond yield farming. The new offering will feature 0% borrow interest rates for various leverage strategies, including yield farming protocols, liquidity providing, staking, and trading.

Lenders will be paid by borrowers’ profit cut only when they make profits.