Euler hack update, MakerDAO votes to keep USDC as reserve asset & approves Constitution, Alpha Homora community approves proposal, CFTC is going after Binance, and more...

Issue #34 of The State of DeFi Lending newsletter

Welcome to issue #34 of The State of DeFi Lending, a newsletter covering the highlights of lending markets in DeFi.

In this issue we cover:

Euler hacker returns >80% of stolen funds with more on its way. The hacker publicly expresses regret as he engages with public through on-chain messages.

MakerDAO approves to keep USDC as the primary reserve asset. The DAO also approves a Constitution and pledges further support towards its new lending Protocol SparkLend.

The Alpha Homora community has voted through a proposal as suggested in the 5th Open Letter. However, Iron Bank seems to be absent from the conversation which delays the process of returning funds.

Binance & CZ have been sued by the CFTC over trading access to US customers. The complaint also confirms CFTC’s position that BTC, ETH and LTC are commodities and not securities.

Read below for more…

News

Euler received $176m back from the hacker - out of a total of $200m stolen fund - and expects to receive the remainder as well.

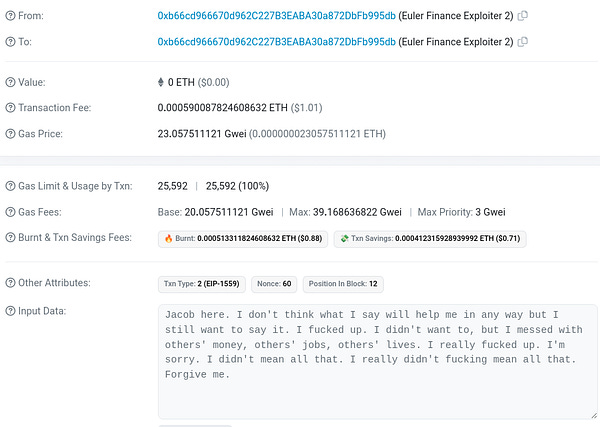

There’s some awkward on-chain messaging going on between the hacker and Euler:

“Jacob here. I don’t think what I say will help me in any way but I still want to say it. I fucked up,” the hacker wrote. “I didn’t want to, but I messed with others’ money, others’ jobs, others’ lives. I really fucked up. I’m sorry. I didn’t mean all that. I really didn’t fucking mean all that. Forgive me.”

Euler says they are negotiating with the hacker but it is unclear what these negotiations are about.

MakerDAO votes to keep USDC as primary reserve asset. The vote was proposed after the USDC depeg

On March 24, the MakerDAO community voted to keep USDC as its primary reserve, with 79% in favor and the rest preferring more diversification. As for the USDC PSM, the proposed parameters were to lower the swap fee for USDC to DAI from 1% to 0% and to increase the target available debt from 250 million DAI to 400 million DAI.

Maker’s community has been particularly busy with various ongoing initiatives, center of which is the Endgame. One critical piece of the Endgame is a Constitution that was approved last week.

The proposal, which passed with 76% support, includes measures for MakerDAO to increasingly decentralize DAI collateral, allow the stablecoin to free-float relative to the dollar, and improve the protocol’s governance.

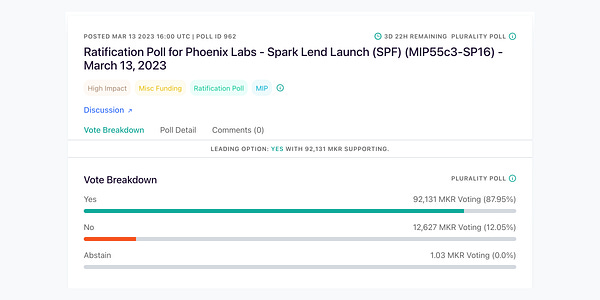

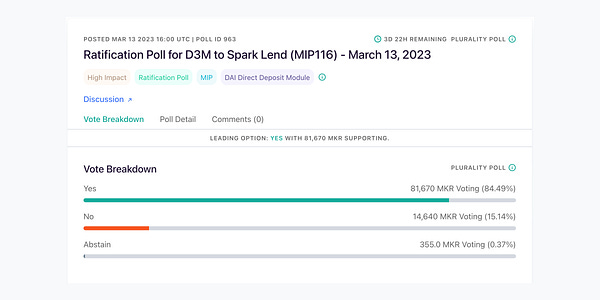

On the operational side, MakerDAO is also pushing ahead with the plans to support Spark Protocol.

As far as Alpha Homora (AH) is concerned, the stand-off with IronBank (IB) is close to being resolved.

The proposal from AH’s 5th Open Letter has been voted through by the community. As a reminder, key elements of the proposal are:

AH commits to paying IB ~1.89M USDT and ~1.92M DAI within 1.5 years, allowing ETH and USDC depositors on Alpha Homora v2 to withdraw excess amounts proportionately (~30% for ETH and ~57% for USDC).

As AH repays the debt, 63M locked ALPHA tokens will be returned from IB to Alpha treasury and distributed to affected users over time.

Additionally, 20% of protocol fees from all upcoming Alpha products will be distributed to depositors over 1.5 years.

The AH community has approved the above proposal and is awaiting feedback from IB to implement the code changes. It appears that communication between the two teams has reached a difficult point with very little direct interaction.

Binance’s and CZ are being sued by the Commodity Futures Trading Commision for allegedly violating federal laws and not registering the exchange in the U.S.

The agency filed a complaint alleging that Binance has “taken a calculated, phased approach to increase its United States presence despite publicly stating its purported intent to ‘block’ or ‘restrict’ customers located in the United States from accessing its platform.”

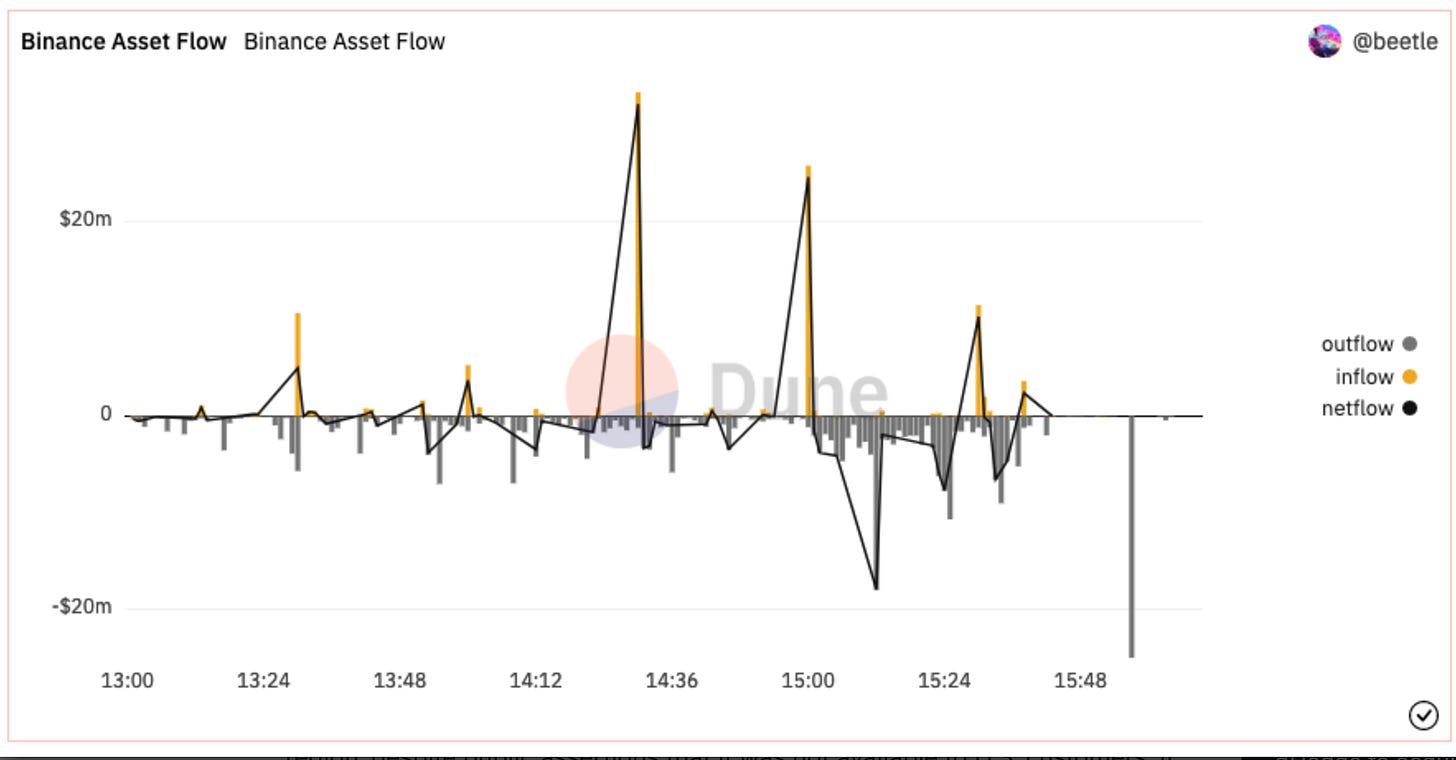

In the hours after the lawsuit was announced, $169 million was withdrawn from the exchange against just $46 million of deposits, a net outflow of $123 million.

CZ’s was swift to publish his response on Twitter.

As an aside, the CFTC reiterated that BTC, ETH and LTC are commodities.