MakerDAO announces SparkLend, SEC is clamping down on staking, Paxos to halt BUSD minting, dForce exploit,…

Issue #28 of The State of DeFi Lending newsletter

Welcome to issue #28 of The State of DeFi Lending, a newsletter covering the highlights of lending markets in DeFi.

In this issue we cover

MakerDAO’s new lending protocol Spark Lend will be built on Aave v3 and have a $200m DAI ceiling. The protocol is supposed to generate additional supply of DAI and support MakerDAO’s mission to establish DAI as the Unbiased World Currency.

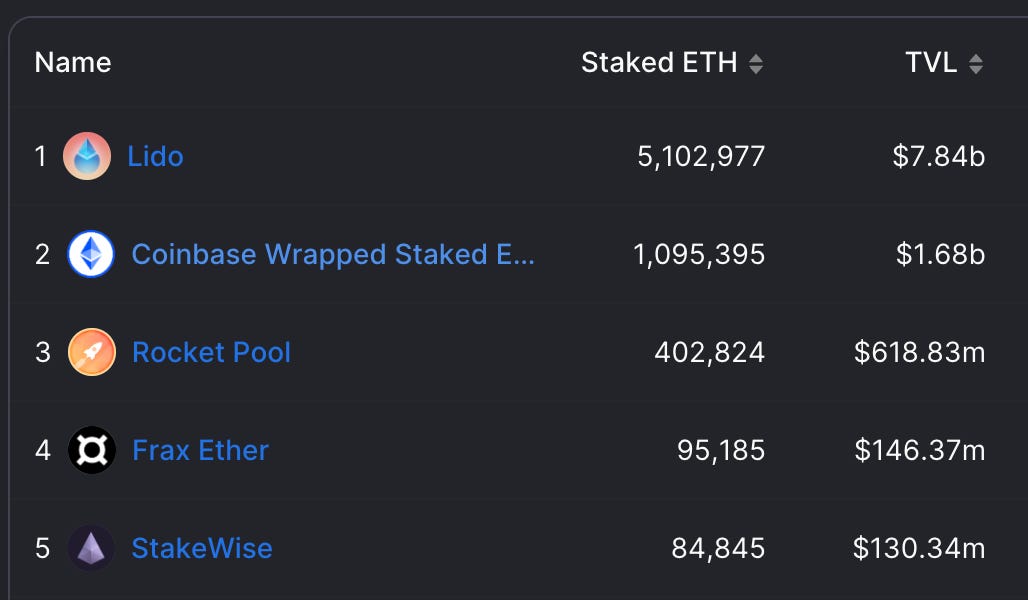

The SEC is going after staking-as-a-service by US exchanges. Kraken is the first victim which agreed to a $30m settlement and to discontinue the service. Coinbase appears more determined to continue operating their ETH liquid staking programme, which ranks 2nd by TVL after Lido.

Paxos, issuer of Binance USD/ BUSD, has been ordered by the NYDFS to stop minting new BUSD. Centralized stablecoins are at the center of DeFi lending and it remains to be seen if other issuers such as Circle might come under fire. BUSD has been a niche stablecoin in DeFi and hence the impact to offboard the token will be limited.

dForce suffered a $3.65m exploit which turned out to have been carried out by a whitehat hacker. All funds are being returned and the vulnerability is being patched.

Read below for more…

News

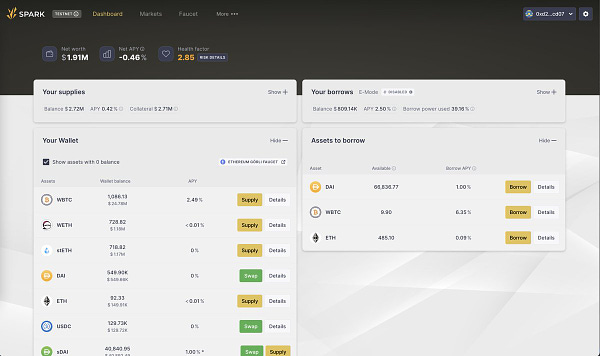

MakerDAO announced Spark Lend, a protocol that builds on Aave v3, is owned by Maker governance and will become one of Maker’s first SubDAOs.

Spark Lend will integrate with Maker’s D3M and have a debt ceiling of 200m DAI. The launch date is expected for April 2023 and 10% of gross profit will be paid to Aave.

There’s been debate in the DeFi community about the move and in how far it encroaches on Aave’s turf, even as retaliation for Aave’s launch of the GHO stablecoin (a potential DAI competitor). A nuanced view of these actions suggests that they are a means to an end: Maker wants to position DAI as the Unbiased World Currency which requires more avenues to mint. Aave wants to become the leading money market and wants to utilize GHO as an internal source of liquidity.

Spark Lend also integrates with Element Finance and Sense Protocol to offer fixed rate lending.

In related news, Maker also announced they will integrate Chainlink as another Oracle and the MakerDAO community has started drafting the Maker Constitution.

The SEC is clamping down on staking-as-a-service operated by US exchanges. As a first casualty to the SEC’s action, Kraken agreed to a $30m settlement and shut down the service.

The settlement is not an admission of guilt or a legal ruling and thus has not helped clarify the judicial stance on staking.

Coinbase CEO appears resolute to defend his stance that ETH staking is not a security and is prepared to go to court.

This is important as cbETH has become the #2 ETH liquid staking derivative that is also gradually adopted in DeFi lending markets.

At the same time, the centralization risk of LSD received renewed attention after these events. Decentralized LSD provider like RocketPool received a major boost as the market acknowledges the need for centralization-minimized products.

In a recent Aave forum discussion, the high centralization of frxETH was quoted as a main point to not onboard the asset.

Paxos, issuer of USDP and BUSD stablecoins, has been notified by the NYDFS to stop minting new BUSD.

Paxos will service BUSD redemptions to minimize disruption. However, the news sent ripples through the stablecoin space. Paxos is also likely to be sued by the SEC over allegations that BUSD constitutes a security.

BUSD is a niche stablecoin in the DeFi lending space. However, there are some BSC-based protocols that utilize the stablecoin and now need to offboard the stablecoin/adjust parameters.

Decentralized and trust-minimized stablecoins like LUSD and the LQTY governance token received a major boost as traders jumped onto the narrative.

Arbitrum lending protocol dForce was exploited to the tune of $3.65m.

However, the protocol has announced this was a whitehat hack and all funds will be returned.

The vulnerability occurred in the Curve wstETH/ETH pool: The attacker's exploited the process of exchanging native tokens without burning LP token during the removal of liquidity. The manipulation triggered a callback for receiving native tokens and allowed the attacker to manipulate market prices. As a result, the attacker was able to benefit from the forced liquidation of other investors.