MangoMarkets gets exploited for $100m, RiskDAO becomes a Recognized Delegate at MakerDAO, CryptoRisks evaluates MKR’s Endgame on 3CRV, Liquity launches Chicken Bonds with native B.AMM integration...

Issue #10 of The State of DeFi Lending newsletter

We are now sending this newsletter every Wednesday, instead of Sunday.

Welcome to issue #10 of The State of DeFi Lending, a newsletter covering the highlights of lending markets in DeFi.

In this issue we cover

Solana-based MangoMarkets gets targeted in a multi-million dollar price manipulation that bankrupts the protocol.

RiskDAO becomes a Recognized Delegate at makerDAO aiming to actively shape DeFi protocol governance.

MakerDAO’s Endgame plan will send ripple effects through DeFi in case of a $DAI depeg. CryptoRisks sheds light at possible risk vectors.

Liquity’s Chicken Bonds have officially launched and are natively integrated with B.Protocol’s B.AMM. Chicken Bonds’ novel bonding mechanism aims to further stabilize the Liquity protocol and $LUSD peg.

RiskDAO publishes valuation framework for Liquity’s “Chicken Bonds” and is awarded the 45k $LQTY research bounty

Read below for more…

News

MangoMarkets is at the center of a price manipulation attack that drains the protocol’s entire liquidity.

On the evening of 11 Oct EST, an attacker created a series of perpetual swaps and spot trades with MangoMarkets native token $MNGO . The attacker managed to manipulate the spot price that led to Switchboard and Pyth oracles updating their $MNGO benchmark price to $0.15+. The price even shot up to $0.91 on Mango’s spot market.

The attack does not appear to be an oracle manipulation but rather a straightforward price manipulation across thin order books that saw the spot price skyrocket.

The attacker then went on deposit these inflated $MNGO tokens as collateral to borrow ~$100m against it.

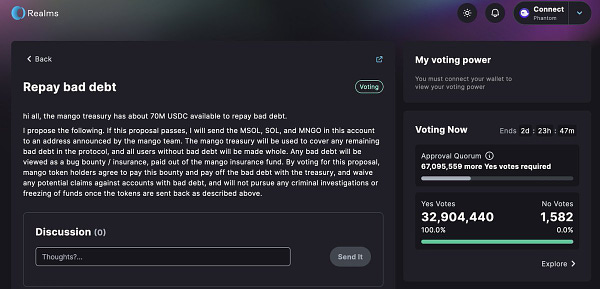

The DAO holds $70m in its insurance fund which is not sufficient to compensate all lenders.

This is a developing story: The attacker has come forward to ask for a bounty and return the funds. The attacker even set up a DAO vote to not pursue legal charges and voted for himself.

This incident resembles other attacks that have occurred recently:

AVAX-USD price manipulation on GMX

Venus Protocol $VXS price manipulation that bankrupted the protocol in early 2021

In response to the AVAX-USD incident, members of the RiskDAO published a game-theoretical analysis for an $AVAX price exploit on AAVE.

Turns out the likelihood of such an attack was much higher on a smaller lending market like Mango. Now it happened.

RiskDAO becomes an official Recognized Delegate for MakerDAO to bring their leading risk frameworks to DeFi protocol governance

MakerDAO is the OG DeFi protocol with network effects that touch all of DeFi. As an established protocol it also features a relatively complex governance process that allows any $MKR-holder to delegate their voting power to Recognized Delegates. The amount of Delegated $MKR has recently reached an ATH with 143k $MKR and 23 Recognized Delegates.

Recognized Delegates are evaluated based on their governance participation: The more they participate and vote, the higher their performance score and multiplier which factors into total remuneration.

RiskDAO was created in May 2022 by DeFi protocol B.Protocol and by the research arm of 1kx, as the first DAO fully dedicated to creating open source risk management tools for DeFi.

RiskDAO and its members have been long-standing contributors to MakerDAO’s ecosystem, involving risk analyses, protocol integrations & security audits.

The RiskDAO is looking for $MKR to be delegated to it in order to have a meaningful influence over MakerDAO’s direction. You can delegate here.

This link takes you to the Delegate Platform.

RiskDAO contributors also participated in a “Meet your Delegate” AMA which is available on YouTube.

CryptoRisks analyzes the impact of MakerDAO’s Endgame on Curve Finance and evaluates scenarios in case of a $DAI depeg

MakerDAO’s Cofounder Rune Christensen shocked the DeFi world when he openly discussed the possibility of a DAI depeg. This is a possible consequence of his proposed “Endgame” which has been heavily debated since its publication.

Rune’s motivation for the Endgame was prompted by the regulatory crackdown on Tornado Cash in spring 2022. His vision calls for an uncensorable form of money that cannot be shut down by regulators. The proposal calls for far-reaching changes to the MakerDAO and the Maker protocol that might trigger a $DAI depeg from USD-parity.

Given how pervasive $DAI is within DeFi and the prominent CRV-3pool, CryptoRisks published an analysis to evaluate the risks from the Endgame plan.

In the scenario of a depeg, users would flock to Curve and redeem DAI for USDC or USDT, thereby heavily tilting the pool balances.

In order to avoid such a “bank run” on one of DeFi’s largest stablecoin pools, CryptoRisks suggests to split the 3pool into a USDC+USDT base pool and a (USDC+USDT)DAI metapool.

It will be interesting to follow how various DeFi protocols prepare for the potential implications of the “Endgame”.

You can find the entire analysis by CryptoRisks here.

Liquity’s Chicken Bonds are officially live and come with native B.Protocol integration

Liquidity’s chicken bonds aim to improve the profile of $LUSD as a DeFi-native, overcollateralized stablecoin. They even come with their own emoji-combo as well as dynamic NFTs.

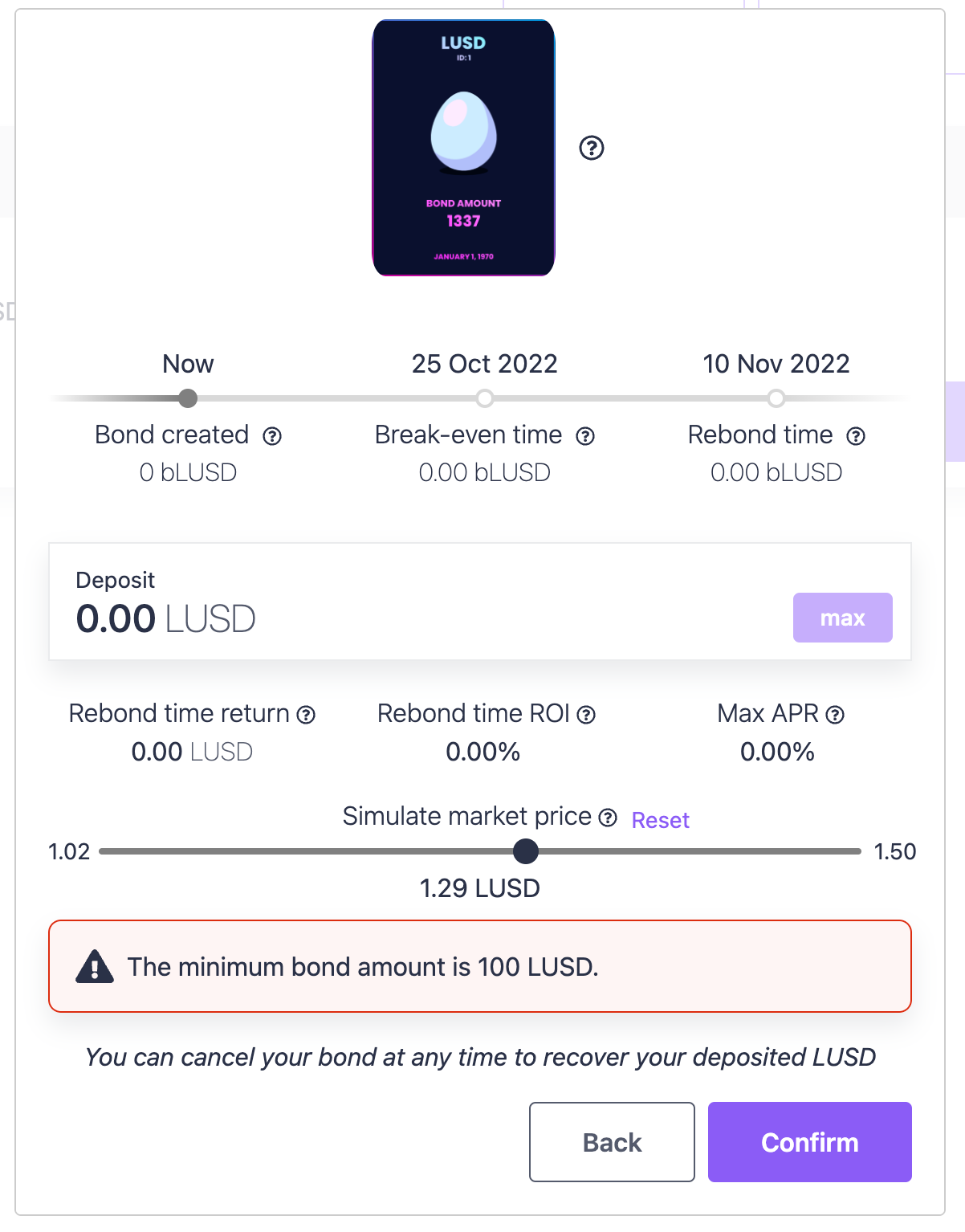

At the core of the Chicken Bonds is a novel bonding mechanism for $LUSD: Users swap $LUSD for $bLUSD to receive amplified, auto-compounded yield (compared to the stability pool) which accrues directly to the $bLUSD price (similar to staked ETH $stkETH).

Chicken Bonds come with a built-in B.Protocol integration:

B.Protocol’s B.AMM is used for auto-compounding by selling $LQTY rewards and $ETH liquidation gains automatically for $LUSD that are deposited back into the stability pool.

It is this B.AMM integration that enables automatic compounding for the Chicken Bonds.

There is more in the works so watch out for additional announcements regarding the integration.

The Chicken Bonds are an iteration of Liquity’s $LUSD stability pool that is backstopping $ETH liquidations in case of market turmoil: The Bonds offers a larger incentive for users to tie up their $LUSD without incurring additional risks.

Bonds accrue a virtual balance of boosted LUSD tokens (bLUSD) over time. At any time, the bonder may choose to claim their bLUSD in exchange for their LUSD, or cancel their bond to recover their deposited LUSD. The principal is fully protected (excluding the yield).

Chicken Bonds offer users the option to rebond: The liquity.app front-end simulates the break-even point and ideal “rebond time”.

Protocol owned liquidity acquired from Chicken Bonds will be used towards improving liquidity on Curve Finance to further stabilize the peg.

The Liquity team published a pretty comprehensive description of the Chicken Bonds that can be found here.

RiskDAO crafts a valuation framework for Chicken Bonds and is awarded a research bounty by Liquity

RiskDAO contributors Robert Koschig and Yaron Velner co-edited a “Game Theoretic Model of Chicken Bonds Dynamic” to come up with a valuation framework.

The difficulty with Chicken Bonds is the “multi-layered” behavioral structure: Chicken Bonds’ amplified yield comes from the entrance fees of new bonds which are dependent on time and participant numbers. Positive/negative feedback loops occur and users are free to “chicken out” as they please.

As part of their research bounty program, the Liquity team awarded RiskDAO a bounty worth 45k $LQTY (c. $33k as of 10 October).

The full report can be accessed here.

Announcements and short news

RiskDAO’s game-theoretical analysis of a potential AVAX-USD price manipulation attack on Aave

Solana’s downtime prevents a $2m liquidation on Mango Market

Aave v3 forum discussion about Chaos Labs’ Risk Simulation proposal

Bankrupt CeFi lender Celsius reveals thousands of customer details in court filings. Celsiusnetworth.com even let’s you look up specific user info.