Mars Protocol introduced, TokenTerminal sheds light into protocol “real” revenue, an overview of DeFi lending trends, DeFiFranc is the latest stablecoin launch, and more...

Issue #9 of The State of DeFi Lending newsletter

Welcome to issue #9 of The State of DeFi Lending, a newsletter covering the highlights of lending markets in DeFi.

In this issue we cover

Mars Protocol is building a new DeFi lending primitive called portable leverage.

TokenTerminal has launched its “real revenue” dashboard with some interesting findings on lending protocols.

A deep dive into the latest innovations in the DeFi lending landscape by Mickey0x from 1kx.

DeFiFranc is launching a new stablecoin that’s pegged to the Swiss Franc (which has largely avoided the USD carnage).

And a few more short updates…

Read below for more…

News

Mars Protocol, incubated by Delphi Digital, has officially announced their whitepaper for v2.

The protocol had originally planned to deploy on the Terra blockchain but is rebuilding in the Cosmos ecosystem now. Mars introduces the concept of portable leverage: Users open a decentralised credit account that’s represented by a transferable NFT (aka the Rover). These Rovers are powered by whitelisted smart contract “credit lines” which are pre-approved by protocol governance. Users will have access to a variety of DeFi activities, all with a single liquidation point. Mars wants to be the “decentralized CEX” and aims to replicate UX-elements that are working very well for centralized exchanges like Binance and FTX.

The magic ingredient for Mars is contract-to-contract lending that is cross-collateralized across strategies. As an example: A user can utilize her spot long position as collateral to yield farm with leverage. There are even much more complex combinations possible (see picture below). Mars aims to improve capital efficiency by taking the best concepts of DeFi & CeFi.

You can find a short presentation by Delphi’s Jose here -

And here is the blogpost.

TokenTerminal released a fantastic dashboard this week breaking down DeFi protocols’ “real” revenue, defined as revenue less the USD-value of token incentives.

You can think of token emissions as marketing costs. Turns out the DeFi OG MakerDAO has the highest gross margin vs other lending protocols.

A more detailed overview can be found here. The dashboard allows you to specify a time range (eg 30 days, 90 days, etc). This is a highly valuable resource that will help gauge the underlying pricing power.

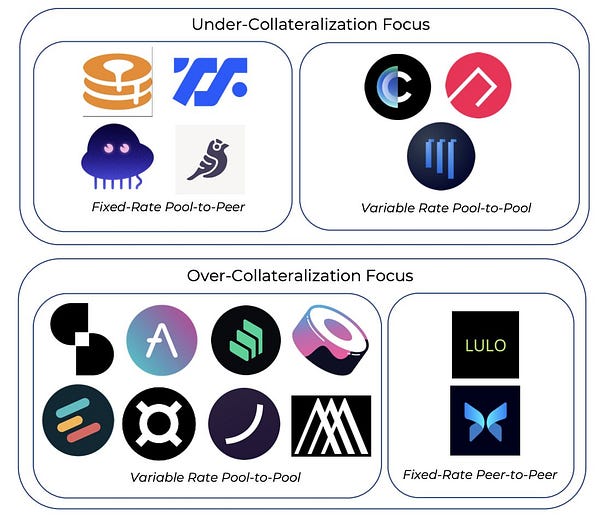

The DeFi lending landscape offers a myriad of protocol designs. Differences exist in the collateralization factor, asset base, interest rate model, and other borrow conditions.

Mikey0x from 1kx did a deep dive into the lending sector. There are some great insights in the tweet thread, and we suggest you read the whole thing.

Some notable data points: The majority of TVL resides on ETH Mainnet and overcollateralized loans dwarf the size of undercollateralized lending.

However, undercollateralized lending is receiving a lot of attention recently with new protocol launches (eg Damm.Finance and Ribbon Lend) and novel concepts for off-chain credit scoring (eg credora.io).

Mikey expects the TVL gap between over- & undercollateralized lending to shrink as more KYC & zk-based credentials are rolled out.

The space remains primed for more experiments and novel primitives that will ultimately benefit DeFi lending as a whole.

DeFiFranc is the latest new stablecoin that offers access to the Swiss Franc (CHF)

Although not immune to the overall USD strength, the Swiss Franc has fared much better than many other developed countries’ FX rates.

DeFiFranc allows anyone to mint DCHF with a 0% interest rate and using WBTC or ETH as collateral. The collateralization ratio stands at 110% with a one-off 0.5% fee.

There is not much to do with DCHF yet, except for deposits into the stability fund that is paying c. 200% APR.

Source: https://app.defifranc.com/stability-pool