USDC depegs and sends ripples through DeFi, Euler gets hacked for $200m, Alpha Homora still not in agreement with Iron Bank, ...

Issue #32 of The State of DeFi Lending newsletter

Welcome to issue #32 of The State of DeFi Lending, a newsletter covering the highlights of lending markets in DeFi.

In this issue we cover

A summary of the US Banking turmoil and impact on DeFi, especially USDC’s depegging event.

Euler was hacked for $200m and is now negotiating with the hacker via onchain messages.

An update on the Alpha Homora x Iron Bank stand-off.

Read below for more…

News

Over the past weekend, the DeFi ecosystem faced an unprecedented stress test as centralized major stablecoin USDC faced extreme pressure. This all began when Silicon Valley Bank (SVB), one of the main relationship banks for USDC, teetered on the brink of bankruptcy. Although not directly related to the crypto space, SVB's financial struggles sent tremors through the entire DeFi landscape.

Circle, the issuer of USDC, had a whopping $3.3 billion deposited with SVB, which represents around 7.5% of the total USDC market cap. As the market scrambled to process this development, USDC started to drift away from its crucial $1 peg. The fallout extended to other stablecoins like DAI and FRAX, all of which are partially backed by USDC.

Amidst the chaos, USDT emerged as the unexpected victor, trading at a premium of up to $1.15 vs USDC on Curve despite its infamous lack of transparency. During the frenzy, traders rushed to exchange their USDC for USDT, causing a significant decrease in USDT liquidity on Curve's 3pool.

At the same time, DAI's 3pool liquidity was also severely depleted. DAI, being an overcollateralized stablecoin, is backed by various collateral assets, with USDC comprising approximately 50% of it. In response, MakerDAO proposed an executive vote to pause the Peg Stability Mechanism (PSM), which mints DAI against centralized stablecoins such as USDC, GUSD, and USDP. The goal was to insulate DAI from the price fluctuations of these centralized stablecoins during times of instability.

USDC has long been regarded as the gold standard for centralized stablecoins, and few anticipated a depeg. Consequently, several lending protocols offer high Loan-to-Value (LTV) ratios on stablecoin lending pairs due to their tight correlation. However, this quickly became problematic during the weekend's turbulence.

Lending protocols like Aave paused liquidations entirely to avoid bad debt. Some protocols (e.g. Compound) had hardcoded the USDC price at $1 given the historic stability. Slippage for USDC liquidations deteriorated drastically as the 3pool ran low on USDT and DAI.

The 4% slippage for USDC/DAI began at $166 million and fell to a low of $15 million, while the 4% slippage for USDC/USDT started at $219 million and plummeted to a mere $1.5 million. The chaotic weekend ultimately served as a valuable fire drill for DeFi, revealing areas for improvement and the need for increased resilience in the face

Impacts on DeFi

Maker passed an emergent Executive Vote to make parameter changes to its vault types, PSM, D3M, and the GSM Pause Delay, mainly to mitigate potential risks and allow the protocol to react faster to market events.

Compound paused USDC minting on V2 and is about to vote to resume minting.

The Compound risk team proposed to pause borrowing for all assets on Compound V2 temporarily, as some existing USDC suppliers are still able to borrow against their collateral.Aave has frozen USDC, USDT, DAI, FRAX, and MAI on Aave v3 Avalanche to prevent new positions from adding risk to the protocol.

Abracadabra’s $MIM went depegged as the Curve MIM-3Pool is the largest liquidity pool for trading MIM, and MIM price was pulled downward by the other major stablecoins in the pool: USDC and DAI.

Other DeFi projects that were affected:

GMX’s GLP pool is 50% backed by USDC

Gains Network is fully reliant on DAI, which is 40% backed by USDC

Frax’s stablecoin is ~78% backed by USDC

For additional reading, Gauntlet has summarised key findings and recommendations for their lending protocol clients. As an interesting takeaway, the article mentions “toxic liquidations” that decrease protocol health.

Euler gets hacked for $200m after a flash-loan attack.

The attack occurred on Monday, allowing the perpetrator to borrow large amounts of funds and drain them from the protocol. The attacker drained from the protocol $136 million of staked ether (stETH), $34 million of USDC, $19 million of wrapped bitcoin (WBTC) and $8.7 million of DAI, according to BlockSec.

“…the attacker exploited vulnerable code which allowed it to create an unbacked token debt position by donating funds to the protocol’s reserves. As a result, the attacker was able to liquidate these underwater accounts and profit from the liquidation bonuses.’

This tweet by Blocksec provides a good way to understand the attack.

Euler Finance's team is working with security professionals and law enforcement.

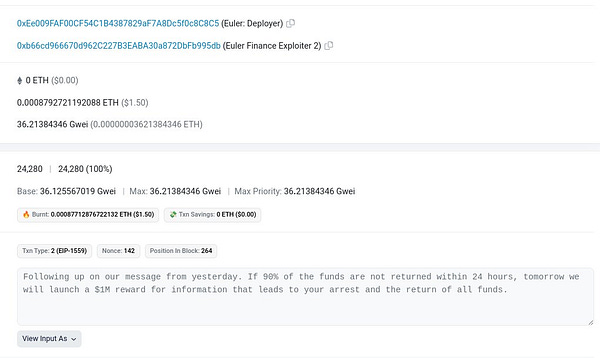

The protocol has started direct negotiations with the hacker via on-chain messages, offering a 10% bounty.

The Euler hack impacts a range of DeFi protocols:

Angle Protocol lost ~18.4m as Angle’s core module invests part of its funds in automated yield strategies, which includes depositing funds in Euler. The protocol has been paused with debt ceilings set to 0, and the Euler AMO has been wound down.

Balancer lost 11.6m sent to Euler from the bbeUSD (Euler Boosted USD) pool. Balancer has paused and put into recovery mode bbeUSD and all pools containing bbeUSD.

Idle DAO lost ~$5m in strategies that invest in Euler. The actual figures can change depending on the insurance coverage and any other plan undertaken by the Euler team.

Yearn lost $1.38m as it has indirect exposure to Euler. Affected strategies include yvUSDT and yvUSDC which invests in Idle and Angle. Devs are working on the fix and the team assures that any bad debt remaining will be covered by the Yearn Treasury.

Yield Protocol lost ~1.5m as the protocol’s mainnet liquidity pools hold Euler eTokens and Yield fyTokens. Yield has disabled the app and paused mainnet borrowing while investigating.

Alpha Homora and Iron Bank continue their stand-off over $32m in bad debt and $40m user deposits.

Almost forgotten in last week’s carnage, this stand-off still has not been resolved. As of last week, it appeared as if AH gave in to IB’s demands and allowed AH protocol bad debt to be transferred to its users. A community discussion had been initiated…

…however, this AH snapshot vote from 13 March highlights that the community is opposed to this solution and wants to hear alternative proposals. The vote has not meached quorum though. As long as no solution is found, $40m of user deposits remain frozen on IB (ETH Mainnet).

It appears the Alpha Homora team is looking at all available options to resolve the situation in the interest of their community members.